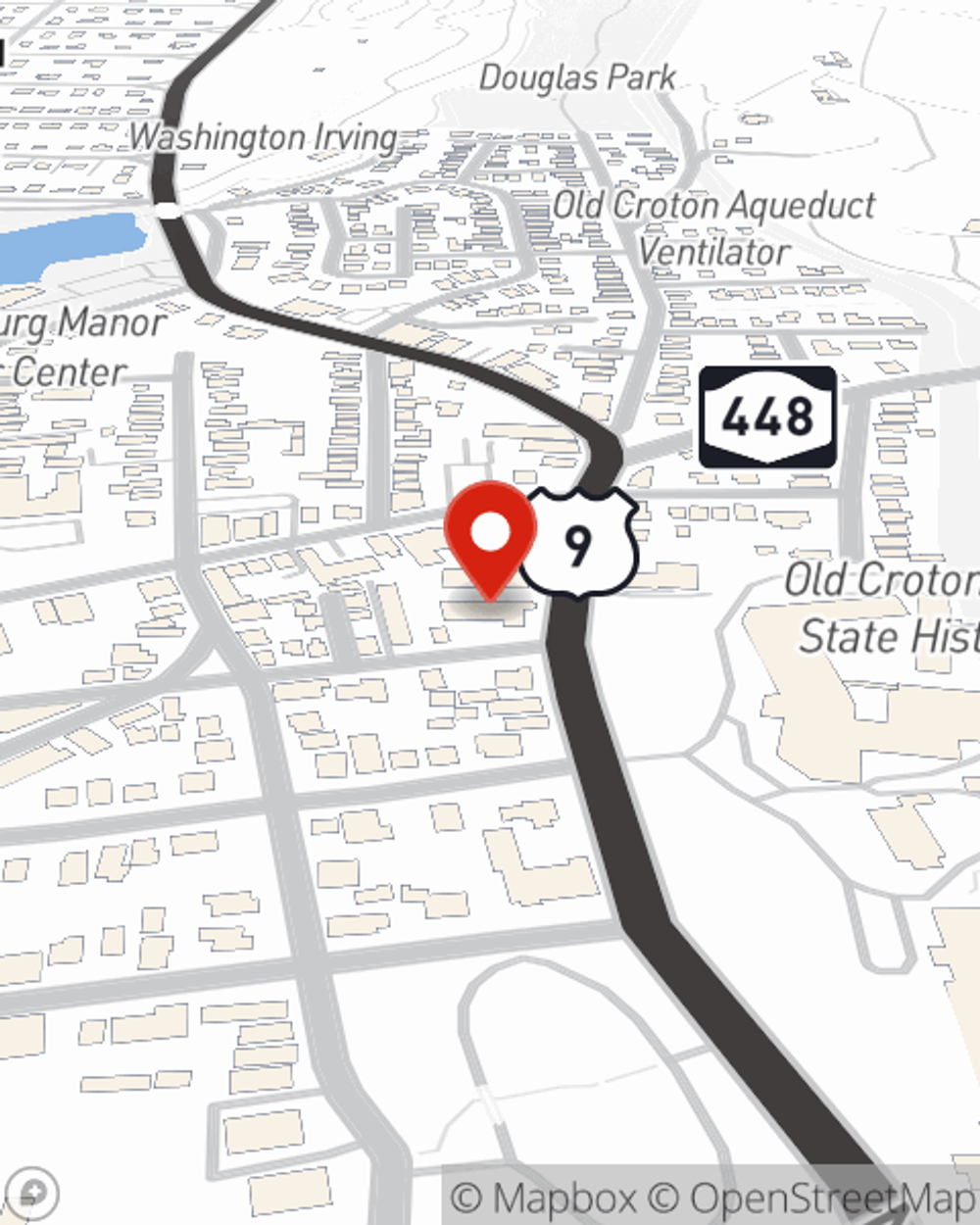

Business Insurance in and around Sleepy Hollow

Calling all small business owners of Sleepy Hollow!

This small business insurance is not risky

- Sleepy Hollow

- Tarrytown

- Briarcliff Manor

- Westchester County

- Ossining

- Irvington

- Dobbs Ferry

- White Plains

- Pleasantville

- Valhalla

- Thornwood

- Yorktown Heights

- Peekskill

- Hastings on Hudson

- Scarborough

- Litchfield County CT

- New Milford, CT

- Brookfield, CT

- Danbury, CT

- New Fairfield, CT

- Sherman, CT

- Bethel, CT

- Ridgefield, CT

- Newtown, CT

Business Insurance At A Great Value!

Running a small business comes with a unique set of wins and losses. You shouldn't have to wrestle with those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, business continuity plans and errors and omissions liability, among others.

Calling all small business owners of Sleepy Hollow!

This small business insurance is not risky

Surprisingly Great Insurance

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a drug store, an interior decorator or a pizza parlor. Agent Kathy Davidoff is also a business owner and understands what you need. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Agent Kathy Davidoff is here to review your business insurance options with you. Reach out Kathy Davidoff today!

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Kathy Davidoff

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.